Best Private Student Loans In June 2025 | The College Investor Video

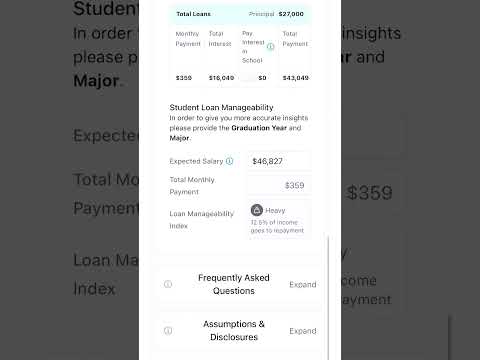

Private student loans can help fill the gap when federal aid isn’t enough. But with so many lenders out there, how do you choose the right one?

In this video, we break down the 10 best private student loan lenders based on loan terms, interest rates, cosigner rules, application experience, and borrower perks like deferment, career support, and multi-year approval. Whether you’re looking for the lowest rate, no cosigner option, or flexibility after graduation, this comparison will help you understand what to expect.

🔍 We cover:

• Who has the lowest rates

• Which lenders offer non-cosigned loans

• What terms and perks stand out

• Which options work best for parents, grad students, or undergrads

👇 Compare your options and get a quote from each lender below:

🟢 Ascent Student Loans

👉 Get a quote from Ascent: link

🟢 Citizens Bank

👉 Get a quote from Citizens: link

🟢 College Ave

👉 Get a quote from College Ave: link

🟢 CU Select Student Loans

👉 Get a quote from CU Select: link

🟢 Earnest

👉 Get a quote from Earnest: link

🟢 ELFI (Education Loan Finance)

👉 Get a quote from ELFI: link

🟢 Funding U (no cosigner loans)

👉 Get a quote from Funding U: link

🟢 LendKey

👉 Get a quote from LendKey: link

🟢 Sallie Mae

👉 Get a quote from Sallie Mae: link

🟢 SoFi

👉 Get a quote from SoFi: link

💬 Let us know in the comments if you’ve used any of these lenders or have questions about private student loans.

📩 Subscribe for more financial tips for students and families!

#PrivateStudentLoans #StudentLoanAdvice #CollegeLoans #financialaid