Blog Feed

This New Bill Could Double Your Tax Savings in 2025

The One Big Beautiful Bill has passed, and it could put thousands of dollars back in your pocket. In this episode, we’re breaking down how this power…

Cutting Taxes & Retiring Sooner w/ Cody Garrett – Episode 1037

Benjamin Franklin once wrote “… in this world, nothing is certain except death and taxes.” It was true over 200 years ago and it’s true today! …

How The Irrevocable Life Insurance Trust Saves Families From the Estate Tax Hammer

Lately, I’ve been thinking more about estate planning. Part of it is just getting older. Part of it is having young children I want to protect no mat…

Making $92,000 (Tax-Free) from One Real Estate Deal

Think you need a big bank account or extensive investing knowledge to buy a rental property? Today’s guest got started with no money down, and this f…

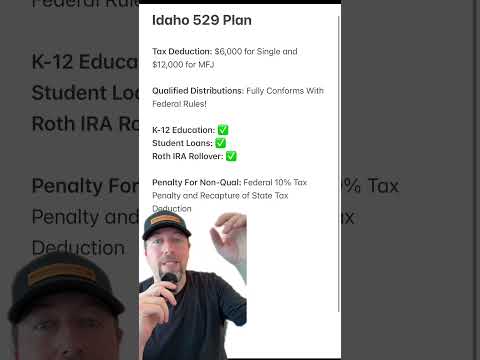

Tax Deductions For Tuition And Student Loans

The IRS tax code includes several tax deductions for tuition and student loans. Learn what these tax benefits are and how to maximize them. The post …

What the “No Tax on Home Sales Act” Really Means For Real Estate Investors

In July 2025, President Donald Trump announced that his administration is considering a sweeping change to how capital gains are treated on home sale…

Becoming a Millionaire by Reducing Your Taxes

Answering reader questions about capital gains taxes and how to limit them, how to use tax losses in retirement, and how to be tax-efficient during y…

2025 Investing Update: Mortgage Rates Fall, New Tax Laws Coming

Is 2025 the perfect time to get into real estate investing? With falling mortgage rates, favorable tax laws, and shifting real estate markets across …

Built to Borrow: The Hidden Forces Behind Debt w/ John Dinsmore – Episode 1031

A lot of folks discover personal finance podcasts like this one after hitting a few bumps in the road – most often with debt. Maybe you’ve maxed…

68 Jobs Eligible For New “No Tax On Tips” Deduction

The Treasury Department has named 68 occupations that qualify for a $25,000 tip deduction from 2025‑2028. Learn which jobs are included and how the r…